Policygenius Review - The Best Insurance Provider Ever

PolicyGenius review: All you need to know about it, Pros, Cons, and more...

Top insurance companies whole and term life plans may be compared using

the PolicyGenius review. It is our choice for the finest online broker since it

enables clients to complete their full shopping process online while still

having insurance professionals on hand to provide you with specialized support

if necessary.

Finding the best insurance provider and comparing rates might be

stressful if you're looking for life insurance. You may utilize an internet

broker to obtain quotations from numerous insurers at once, rather than

directly requesting rates and policy specifics from individual firms.

PolicyGenius review

A marketplace for insurance where you can compare prices for various

insurance kinds is called Policygenius.

You may get prices for a range of insurance policies, including pet

insurance and life insurance.

The market offers comprehensive information to assist you in

understanding the many forms of insurance.

To discover the proper coverage for you, at the best price, Policygenius

can assist you in comparing life insurance products.

Quick Look Review of PolicyGenius review

- The organization's name is Policygenius.

- Company type is an online broker or comparison portal for insurance.

- Multiple quotations, a user-friendly product, and live support are all important features.

- Cons is Limited collaborations and a slow-moving procedure for a digital brand.

- The company is best For Comparing prices and seeking out unbiased guidance.

How Policygenius Functions

About Policygenius review and its use: You need to provide some basic

information (which, depending on the type of insurance you're searching for,

might be more or less comprehensive) on the Policygenius website. The best

alternatives are then returned by Policygenius once it has put them through its

algorithms.

Then, in order to complete the purchase, you are routed to the insurer's

website of your choosing.

What is the price of Policygenius?

Because it receives compensation from insurance providers for each sale

it makes, Policygenius is free to use. You are not charged any additional fees

for using Policygenius because such commissions are already included in the

cost of the insurance policy.

However, the price of the insurance you're looking at will vary

depending on a number of circumstances, such as:

- Insurance class.

- The intended extent of coverage.

- Risk elements.

- Several other factors.

It's crucial to remember that Policygenius doesn't display all of your

insurance options. You might be able to receive a better deal by utilizing a

business that doesn't partner with Policygenius. For this reason, it's usually

a good idea to conduct some comparison shopping.

Application Process for Policygenius

It simply took me a few minutes to get a quotation from PolicyGenius

review.

To begin, I first entered my information in the widget above.

After that, Policygenius will inquire whether you are currently

considering life insurance, are only comparing rates, or are prepared to make a

purchase. After that, it queries your motivation(s) for obtaining life

insurance, including:

- Choosing the appropriate insurance for your medical needs.

- Paying for ultimate expenses like funerals.

- Building a safety net for your family.

- Preventing the transfer of your debts to others.

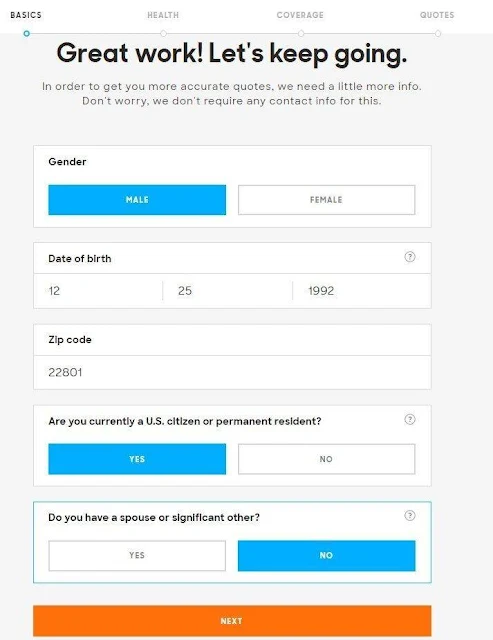

Policygenius will need some basic information from you after you've described your particular circumstance. Your gender, birthdate, postcode, citizenship status (U.S. citizen or permanent resident), and whether you're married or in a committed relationship must all be provided.

On this page, you will need to include the following details:

- Its height.

- The scales.

- The last five years of tobacco consumption.

- If you have ever been in treatment or taken medication for any of the following medical problems.

- If you've had your license suspended or revoked, had many tickets, or been in an accident within the last five years.

Following that, Policygenius provides the beginning prices for life

insurance plans based on the level of coverage and term you select.

You will now be asked to sign up for a

Policygenius account in order to continue. Your name, address, phone number,

email address, yearly income, and the source of your Policygenius information

are all required.

Your application is now being reviewed. An authorized specialist will

examine your application and telephone the data to validate them.

The life insurance provider of your choice

will conclude the process of accepting you for your life insurance policy after

everything with your application is finished. A physical examination could be

part of it.

Pros and Cons of PolicyGenius Life Insurance

PolicyGenius review: PROS

Allows for the comparison of several quotations at once

In the past, obtaining life insurance quotations from several firms

manually required time-consuming effort, or you could hire an insurance broker

to conduct the investigation on your behalf. With PolicyGenius review, the

procedure is discovered that it is streamlined and made simple, enabling you to

complete a single form to obtain quotations from a number of leading insurers.

Not a part of an insurance provider

PolicyGenius is not an insurance business and does not own one, like the

majority of other brokers. In order to provide you with balanced information,

it offers insurance products from several firms without favoring any

particular one of them.

Available are fully licensed agents

You might need to speak with an insurance agent in some situations, even

if you make your purchase online, due to unique circumstances or to get

clarification on the insurance purchasing procedure. Contrary to other brokers,

PolicyGenius offers fully-licensed agents that are available via phone or text

to assist you.

Several alternatives for term insurance

Many individuals choose term life insurance, but some companies only

provide benefits of $2 million or less or durations of no more than 30 years,

to name just a few restrictions. You may compare rates from many insurers for

periods of up to 40 years and coverage of up to $10 million by using a broker

like PolicyGenius.

PolicyGenius review: CONS

Although brokers like PolicyGenius make it possible for you to compare

rates from many insurers at once, not all insurance providers cooperate with

them. If you're ready to conduct your own investigation, you might be able to

discover cheaper prices elsewhere, as they only offer estimates from partners

that pay commissions.

Typically, medical examinations are necessary

The majority of PolicyGenius insurance is thoroughly underwritten and

needs physicals. You might need to engage with another firm if you want simple

issue or guaranteed issue plans.

Several partners have unsatisfactory customer ratings

Customer satisfaction scores differ by an insurer because PolicyGenius does

not sell insurance policies. While a handful of the businesses have received

excellent reviews, the majority have negative customer service ratings. (PolicyGenius

offers support throughout the purchasing process. However, after purchasing the

coverage, you'll deal with the insurer about any customer service concerns,

therefore business customer satisfaction scores are crucial.)

Options for insurance on Policygenius

You may request quotes for and buy term and whole life insurance with

PolicyGenius review. You will collaborate with a PolicyGenius representative to

complete your quotation and submit your application after selecting a policy.

Options for insurance on Policygenius, such as the following:

Health insurance through Policygenius

Although Policygenius doesn't offer health insurance quotes directly on

its website, it does provide a comprehensive instructional reference that

covers the fundamentals of health insurance, different forms of health

insurance, and typical health insurance rates. Additionally, it lists each

health insurance marketplace's locations per state. Most lead to the federal

healthcare site, healthcare.gov.

Renters insurance with Policygenius

About PolicyGenius review renters, insurance can cover the cost of

replacing your possessions if they are lost or destroyed while you are renting

a flat due to a fire, theft, water damage, or another unforeseen event.

Habitational insurance

Many mortgage lenders may insist that you maintain insurance for the

duration of your loan so that you are financially covered in the event that

something unfavorable occurs to your house. Homeowners insurance might need

the longest quotation request procedure, but there's a good reason for that:

it's one of the most comprehensive coverage options on this list.

Insurance Policygenius life

A death benefit, or amount of money given to a designated beneficiary

after a policyholder passes away, is provided through life insurance and is

tax-free. It could provide the bereaved family with financial security. Before

you must renew your term life insurance (generally at a greater rate as you

age), it lasts for a set amount of time. In contrast, permanent life insurance

is permanent and provides both a death benefit for your dependents and a cash

value that you can utilize at any time.

Auto insurance with Policygenius

In the event that you have an accident that results in someone being

hurt or having their property damaged, auto insurance financially protects both

you and your vehicle. The minimum amount of auto insurance necessary varies by

state.

Insurance Policygenius disability

Long-term disability insurance (more than 30 days away from work)

replaces your income in the event that you are unable to work due to a sickness

or injury.

Investing in disability insurance might be a smart step to safeguard

your income in an emergency.

Pet insurance with Policygenius

Consider pet insurance to help cover the full cost of your medical bills

and safeguard your finances from significant unforeseen expenses.

Additional insurance options offered by PolicyGenius review

You can receive quotes on: in addition to the primary insurance rates

Policygenius provides above:

- Insurance for long-term care

- Vision coverage

- Travel protection

- Jewelry protection

- Identity theft protection

Depending on the insurance type you choose, you can be sent to an

external website or given a list of reliable partners to choose from.

In addition to offering insurance choices, Policygenius also lets you

write a will or trust online starting at $120.

Which insurers does PolicyGenius partner with?

Top life insurance providers who collaborate with PolicyGenius review

include:

- AIG

- Brighthouse Financial

- Lincoln Financial Group

- Pacific Life

- Prudential

- TransAmerica

How is PolicyGenius profitable?

For each sale completed through the website, insurance firms pay a fee

to PolicyGenius. You don't have to pay more to get insurance with PolicyGenius

because the commission is already included in the rate quotations.

Policygenius: Is it reliable?

Given that Policygenius has several complaints posted on its website,

the Better Business Bureau rates the company's trustworthiness as A-. The BBB

assesses a company's trustworthiness by looking at how it handles customer

complaints, is truthful in its advertising, and is transparent about its

business processes.

There haven't been any recent controversies at Policygenius. You can

determine that Policygenius is the right insurance marketplace for you based on

its good reputation and high BBB rating.

Who is PolicyGenius' owner?

Private business PolicyGenius is. Francois de Lame and Jennifer

Fitzgerald launched it in 2014.

How We Judged the Policy of Life Insurance

We considered the following things when assessing PolicyGenius review

and other life insurance providers:

- Plans and terms offered.

- Coverage riders.

- Policies' exclusions.

- Drafting procedure.

- Cost.

- Monetary security.

- Consumer assistance.

- Customer feedback.

- Independent evaluations.

Final Reflections

PolicyGenius review has a significant budget. Its creators are

experienced marketers. The company is known for making significant advertising

investments.

Because of such, I frequently have my doubts about the caliber of a

company's goods. However, it didn't take long to see that Policygenius had

utilized its resources to retain clients rather than merely get them by

providing a range of goods, recognizable brands, and several degrees of

touchpoints based on consumer research.

Using Policygenius does not get around Clark's main criteria for picking

a term life insurance provider. You must still confirm that the business from

whom you purchase has an A++ A.M. Best rating.

Additionally, Policygenius wants you to go via a gatekeeper who gives

you phone-based guidance. According to the corporate website, you will often

have to wait four to six weeks before receiving an offer that can be taken

advantage of. In contrast, with a business like Fabric, the entire purchase

procedure may take less than 15 minutes.

However, Policygenius can save you time while looking for term life

insurance. By entering your information simply once, you may request estimates

from more than 20 providers.

Additionally, it's preferable if the individual you ask to assist you in

making your purchase is someone who won't benefit financially from doing so.

Certainly, Policygenius does that.

Post a Comment